Almost every online travel agency or coupon company claims to be a market leader in their own segment with hundreds of thousands of visitors monthly. They try to convince you that you are missing out on the biggest opportunity of your life if you do not enter into a contract with them.

Well, I have good news for you: there’s a simple way to find out the truth.

How can you verify that the company is actually as successful as they claim to be?

Before you invest a lot of energy into uploading your hotel details and into contracting with these companies, what are you checking out first?

Most people I’ve talked to try to look at the number of their Facebook followers or check how many contracted partners the company has.

However, there is another, more sophisticated and effective way to get this information. Similarweb.com is a service designed to check traffic statistics of any website with the right number of visitors (it works best with sites that have over a thousand visitors a day).

How to use the similarweb.com service for OTAs?

You want to partner up only with agency sites that do have their own traffic. By ‘own traffic’ I mean that they don’t just try to catch guests who are looking for you directly; they’ve actually built a brand, and guests are looking for accommodations directly on their platform.

I’ll show you what to watch out for when analyzing a partner candidate by using similarweb.com. It’s really easy to use. Enter the partner’s website address in the search box. In the example below, we will use booking.com

After typing in the website, watch out for the following, going from top to bottom:

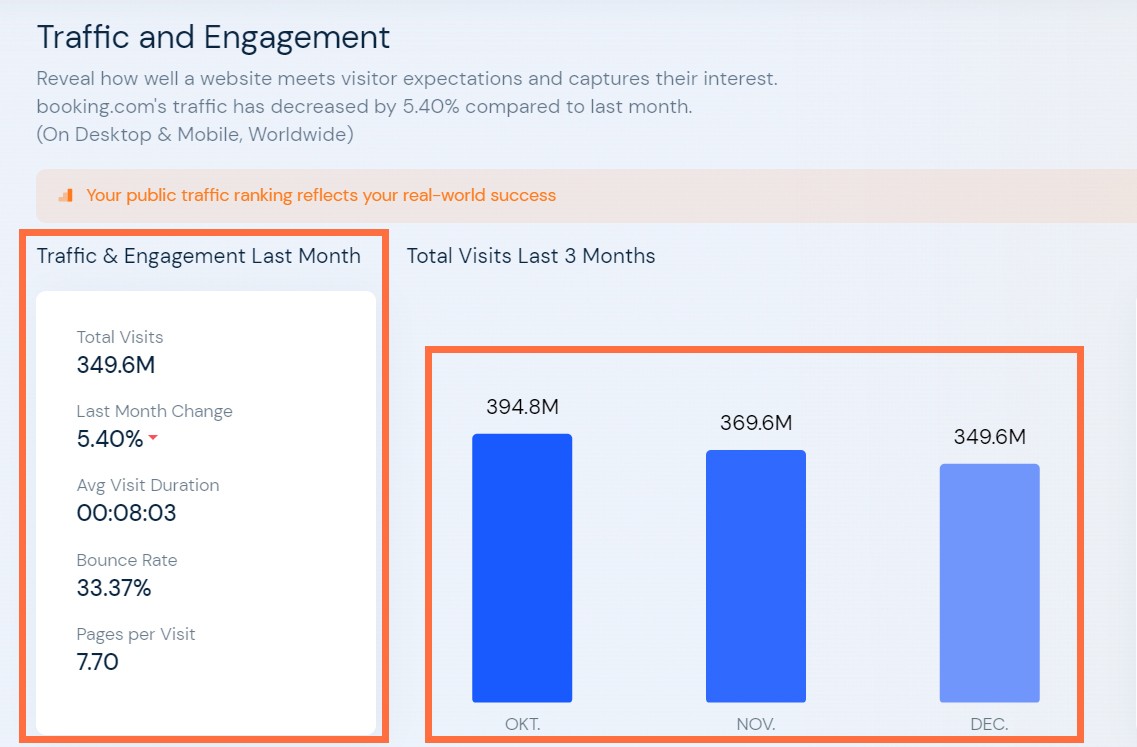

In the Traffic and Engagement section, you can see the website’s estimated monthly number of visitors in the last 3 months. So you’ll immediately catch the partner red-handed if the data you saw in their promotional material was a bit overblown.

You should also look at the data in the white column. Here you’ll find numbers from which the quality of the website visitors can be inferred.

For example, if the Bounce Rate (visitors who exited the website after visiting the first page) is higher than 40%, one can assume that the site is engaged in mass marketing that isn’t aimed at people who are actually looking for accommodations, so they are not targeting the relevant audience.

This isn’t good for you because such sites don’t get you potential guests.

The amount of time spent on the website (Avg. Visit Duration) and the number of pages viewed (Pages per Visit) are both similarly informative numbers.

If visitors spend less than 1-2 minutes on average on a page and don’t look at more than 1-2 pages, then you can be quite certain that the website traffic is not of good quality.

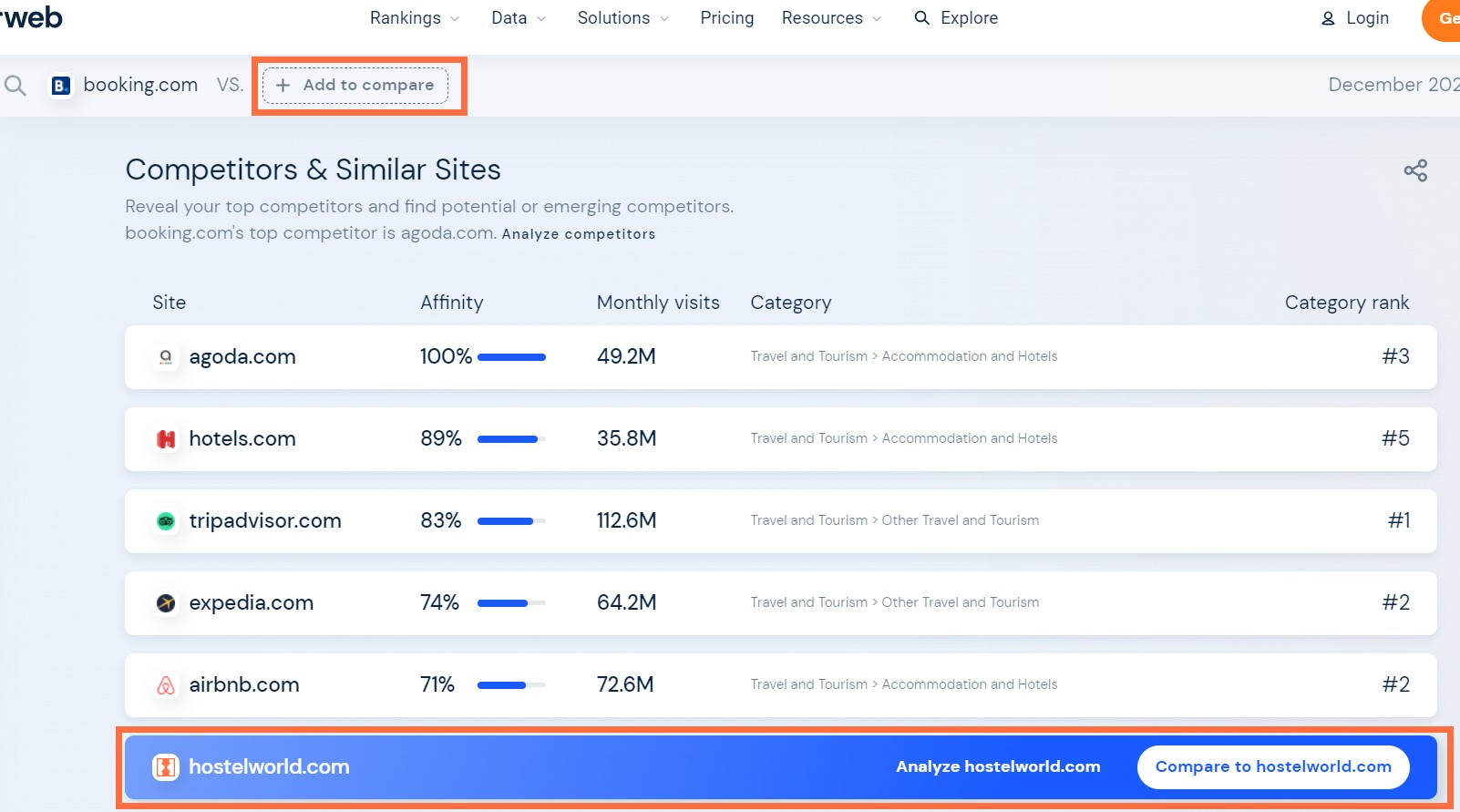

The easiest way to decide whether to contract with a new partner (or terminate the contract with an existing one), is to compare the data to a website that actually brings you guests. You can easily do this by clicking the ‘Add to compare’ button beside the website’s name on top of the page or by selecting a company from the list of competitors in the Competitors & Similar Sites section.

Comparing hostelworld.com to booking.com, the differences are quite noticeable for every area.

Their monthly traffic is much lower (although, being compared to booking.com, that in itself is not necessarily a bad indicator), and the quality metrics are also lower. Visitors spend almost half as much time on the site, viewing fewer pages, and their bounce rate is also worse:

What else to keep in mind to make sure you make a well-founded decision?

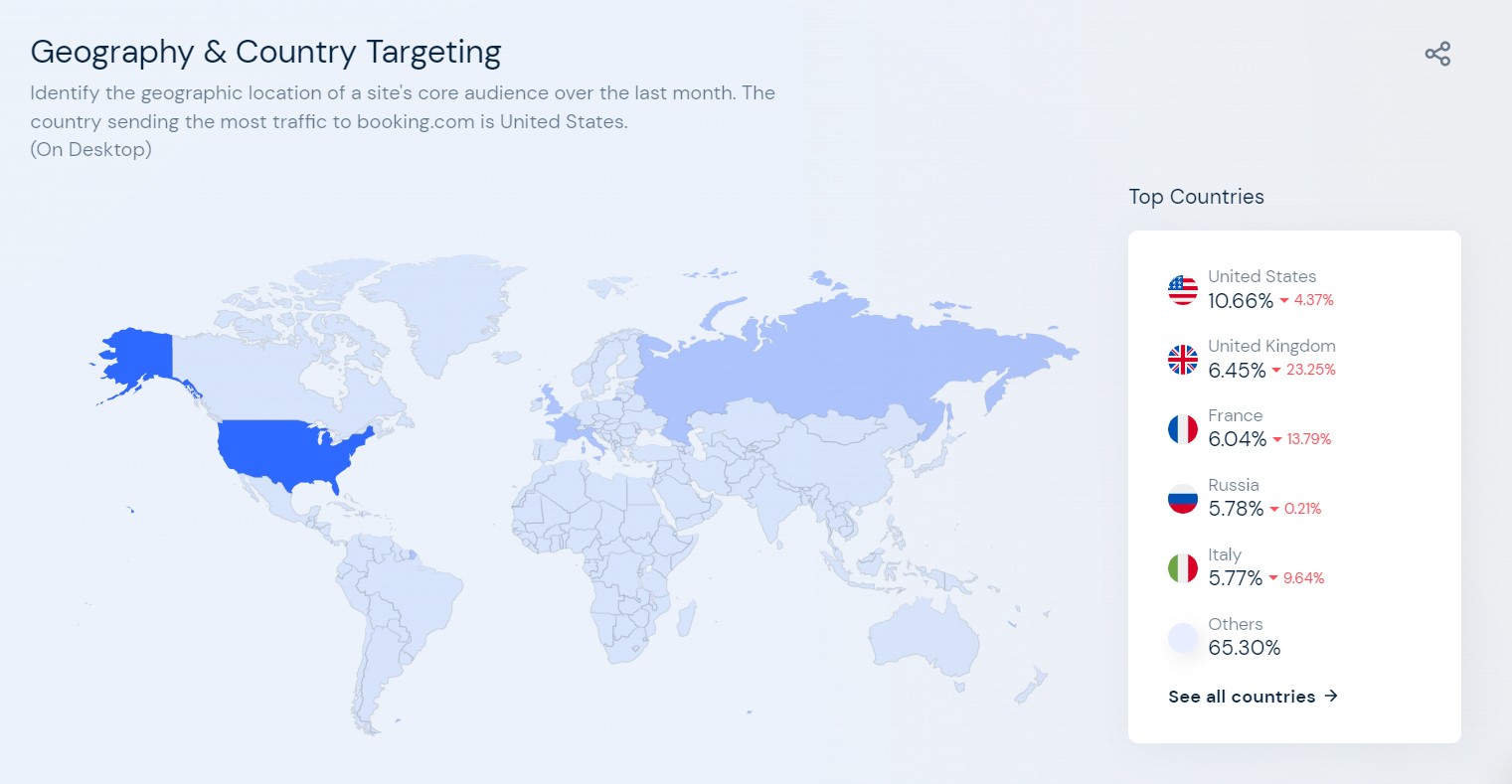

In the Geography & Country Targeting section you can see what geographic locations and countries most of the OTA’s visitors are coming from.

If the travel agent’s core audience is not coming from your top inbound markets, you’re likely to expect little traffic from them.

Unless, of course, you’re planning to target a completely new market and are willing to take that risk.

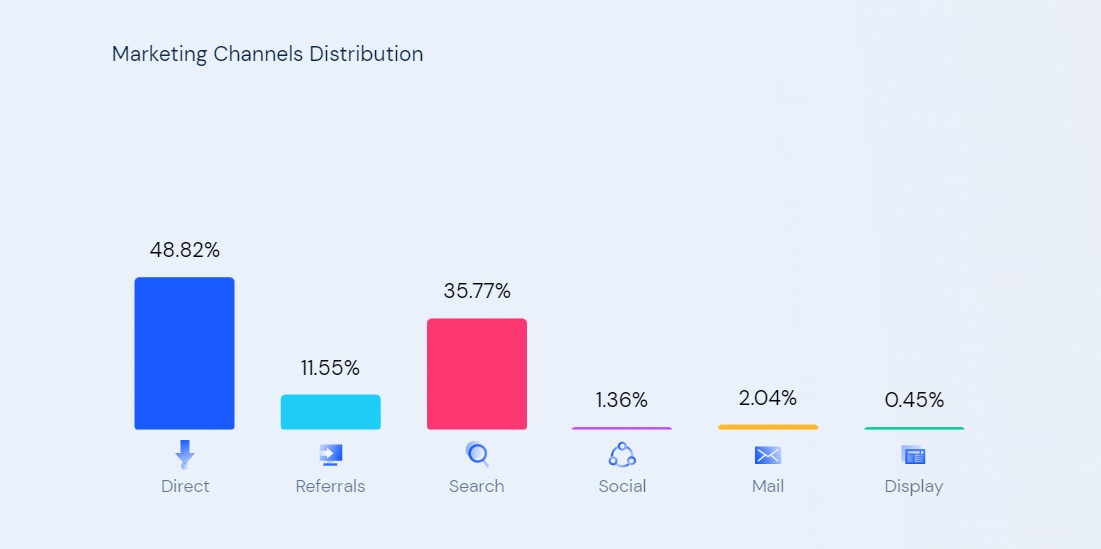

Check Marketing Channels; the higher the proportion of direct traffic, the better, as this indicates that most visitors arrived to the website by typing in the website domain directly (maybe even saving it to their favourites) or clicked a link in a newsletter.

Both indicate that the site doesn’t steal potential guests from you, but can actually bring in new ones.

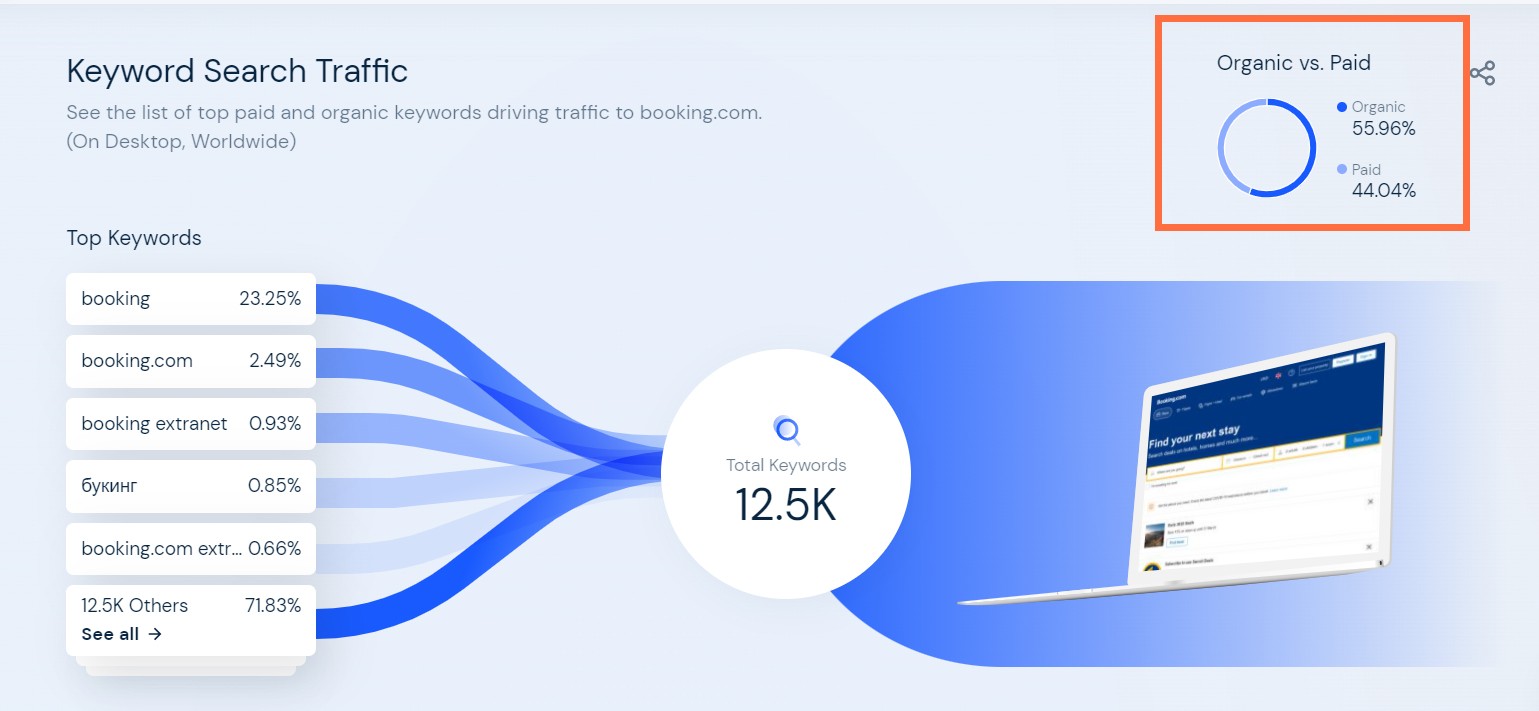

The Keyword Search Traffic lets you know what the paid and non-paid (organic) keywords are that drive the most traffic to the website.

The keywords themselves can provide interesting insights, as you can find out what topics most of the page visitors are interested in, and whether this is in accordance with the services you provide or not.

But the emphasis is more on the ratio of Organic vs. Paid keywords. Here, the ideal ratio is half to half. Too many paid search results may indicate that the brand is yet unknown and lacks its own traffic, which isn’t ideal for you.

If the portion of organic searches is too high – as high as 90% – and the website traffic is low, this can be a warning sign that the company is too small and they have no money to advertise.

If you choose OTAs by taking into account the above, you’ll certainly not waste your time and commission fees on a partner that is unable to bring you enough guests. Also, I highly recommend that you check your existing partners on similarweb.com and simply terminate underperforming OTA partners who generate low traffic.

The only exception to this rule is if the partner serves a segment that is truly specifically targeted to your clientele. For example, if your hotel offers dog-friendly services (dog-friendly rooms, special equipment, dog walking opportunities), then you can gladly contract with a partner who runs a website for dog owners.

But this is only true if the targeting is that specific. If someone specializes in accommodations in London, for example, that doesn’t count, because any major accommodation provider will be able to meet the needs of this market.

How to use similarweb.com for coupon websites?

The method is essentially the same as described above. The difference is that coupon websites use a fundamentally different strategy to acquire guests, so you should see much higher numbers for direct traffic, and search traffic won’t show too much paid search either.

Overall, I suggest that you compare new players to an existing, well-proven partner – assuming they are in the same country or target market. The rest of the metrics won’t be significantly different, and they are of less importance because even newly established coupon websites use a different strategy rather than collecting thousands of hotels to advertise on their behalf. So feel free to make an informed decision purely based on traffic data (number of visitors, time on page, etc.).

How much does all this cost?

These basic traffic and marketing data shown above are available for free to everyone on similarweb.

But if you want to see the top 50 list instead of the top 5, or you want to know where your partners or competitors are running ads and what their creatives look like, you have to reach deep into your pocket. You can find the current similarweb pricing here.

However, before you subscribe, I suggest that you check if similarweb has data about the pages you are interested in, because as I mentioned at the beginning, low-traffic sites (5,000 visitors / device / country per month) will show only partial data or no data at all.

You may also be interested in:

This is how Pálos Resort more than doubled its pre-season occupancy through its own website

"A fairytale view of the forest, silence, tranquility, clean air. You can read, have a drink, relax in a hammock, watch deer in the evening, look at the starry sky from a deckchair at night." This is Palos Resort. A magical, family-run resort in an idyllic setting in...

What a cookieless world means for your hotel marketing and how to prepare for it?

Cookies have always been the online advertising industry’s main method to retarget customers. But soon we’ll have to say goodbye to 3rd party cookies, as by 2023, marketers will be living in a cookie-less world. Joining its competitors, Firefox and Safari, Google...

The most important hotel digital marketing tools in 2022

Do you remember the times when you had to walk to the phone booth to call someone? Or when we had to go to the library to gather material for our thesis? Or that travel agencies used to send reservations by fax? If your answer is no, then you’ve probably grown up in...

By hotel type

City hotels

Resort hotels

Hotel chains

By method

Facebook and Google Ads managemenet

Hotel website personalization

Email marketing & automation

Recent Comments